Investing in real estate is a solid way to build wealth through either rental income, owning property, housing appreciation, or all. In this article you’re going to get a crash course on the process including:

- Ways to invest in real estate

- The pros and cons.

- Alternatives to real estate (why digital real estate is a great option)

Real estate investing explained:

Real estate involves acquiring property such as land, houses, or buildings and then either selling them, keeping them or renting them out for profit down the line. Here are the most common types of real estate investments:

- Residential: Buying homes to rent out.

- Commercial: Investing in business properties.

- Industrial: Warehouses or distribution centers.

- Retail: Storefronts or shopping centers.

- Mixed-Use: A combination of residential and commercial in one property.

In terms of making money off these investments, here are common options:

- Direct Purchase: Buying property outright to rent or sell.

- REITs: Purchasing shares of a company that owns real estate.

- Real Estate Funds: Investing in a pool of properties or real estate stocks.

- Crowdfunding: Joining other investors online to buy property.

- Flipping: Buying, renovating, and selling homes for a quick profit.

Pros:

- Steady Income: Earn regular rental payments.

- Leverage: Buy more with less using loans.

- Appreciation: Properties usually increase in value.

- Tax Benefits: Deduct expenses to save on taxes.

- Cash Flow: Rental income can cover costs and add to your earnings.

Cons:

- Time-Heavy: It takes a lot of effort to manage one or more properties.

- Big Upfront Cost: You need a lot of money to get started.

- Hard to Find: It’s not easy to locate the perfect property.

- Unexpected Problems: You might face surprise repairs or difficult tenants.

- Not Quick to Sell: Selling property can take a while, unlike stocks.

- Prices Can Change: The value of your investment can go up or down unexpectedly.

- Market volatility: This can affect buying/selling prices substantially, especially during recessions.

- Red tape: Lots of paperwork and time waiting is often required.

Is investing in real estate worth it?

Although investing in real estate requires can be very lucrative, it is very important to be open minded about it in that you should decide on whether or not it’s worth it based on your budgeting (you do need money to get started), the pros and cons mentioned above and consulting with a professional if you’re serious about getting involved in it. This post was meant to be a crash

There is a big learning curve for any beginner to real estate regardless of what type of investment they are interested in so very often your first investment is going to be the most difficult, yet most educational and depending on how that goes, you can decide whether or not it’s worth further investing in the future.

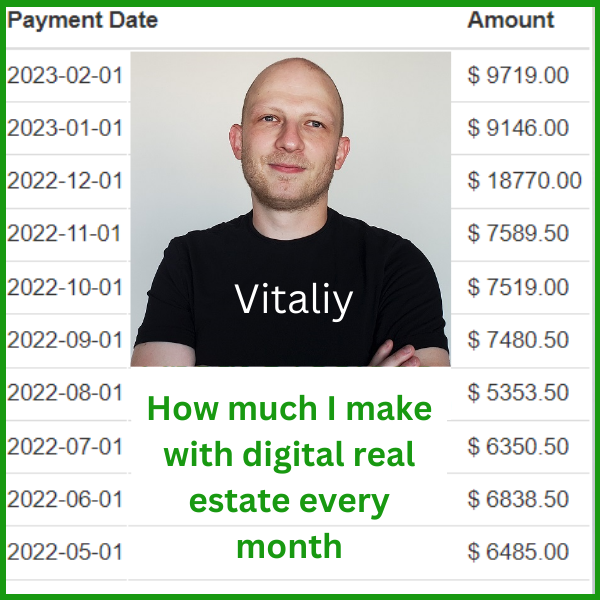

Better alternatives? Yes! Why digital real estate is my go to option (my results):

Digital real estate is the online version of traditional real estate where instead of owning physical property such as houses, apartments, REITs, you own digital properties such as websites, stocks, cryptocurrencies and other digital assets and they can carry greater value than real estate assets. Here’s an example of my personal results investing with digital real estate:

I was taught how to create a successful digital marketing business thanks to a program called Wealthy Affiliate which teaches people how to build profitable websites (digital assets) on any passions they have in life. They offer a free membership and teach you how to make websites from nothing to income generating businesses which you can earn monthly income from and/or sell down the line for prices that can in some cases even surpass what you’d make doing traditional real estate.

Just as well, there are way more pros and far less cons to being involved in digital real estate vs traditional real estate and here are the top 5 reasons:

- Cost of entry is low: You can literally get started for free

- No red tape: No long waiting, massive paperwork, etc…

- Very beginner friendly: Anyone can get started with this with the proper guidance (details below)

- Variety of options available: Building/buying/selling websites, cryptocurrencies, stocks, etc…

- You can make as much if not more: A website can earn you more monthly than a rental property and selling it can potentially net you more than selling a house (proof below).

Here’s a video I made with everything you need to know about digital real estate:

Here are real success stories of people building their own digital assets and succeeding with digital real estate thanks to Wealthy Affiliate:

Click here to join Wealthy Affiliate for free (and start your own digital real estate business)

Have questions? Ask below 🙂